China is expected to generate $42 billion this year as travel preferences shift towards domestic tourism and an increase in foreign visitors, as detailed in a Bloomberg Intelligence analysis. This development is seen as a significant advantage for an economy focused on boosting consumption.

With the effectiveness of government subsidies for consumer goods waning, households are becoming more inclined to spend on services like tourism, especially as international travel sees a decline.

As a result, Bloomberg Intelligence predicts that $27 billion will be diverted to the domestic market from international sources, alongside an additional $15 billion from tourists drawn to China through its visa-free agreements with multiple countries.

“While direct stimulus for durable goods shows its limitations, the tourism sector emerges as a potential catalyst for increased consumption,” analysts including Catherine Lim, Chang Shu, and Eric Zhu noted in a report published Thursday. “Changes in consumer behavior provide a more reliable boost.”

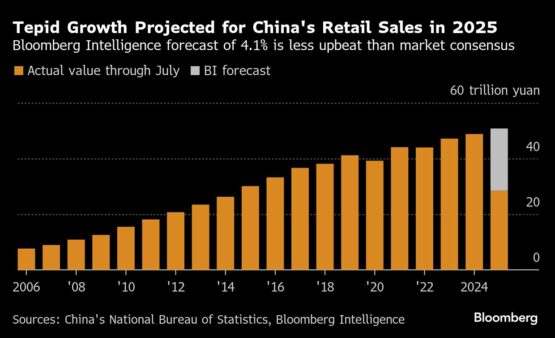

Despite previously experiencing consistent double-digit growth, retail sales are expected to grow by only 4.1% in 2025. This is below the market consensus from August, which estimated a 4.6% annual increase, resulting in a discrepancy of approximately 254 billion yuan ($36 billion).

ADVERTISEMENT

CONTINUE READING BELOW

“This gap highlights the inherent shortcomings of subsidy-dependent consumption, which can lead to front-loaded purchases and ‘subsidy fatigue’ instead of sustained demand,” the analysts emphasized. “Moreover, the prevailing environment is complicated by trade and geopolitical tensions alongside a sluggish property market recovery.”

Local market leaders like Trip.com and Xiaomi Corp. are among the businesses likely to benefit, as customers lean towards affordable premium products. Brands such as Anta and Midea are also projected to gain from the travel spending that Bloomberg Intelligence indicates as “a significant opportunity” for China.

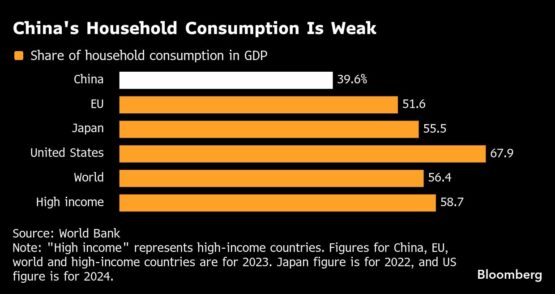

The Chinese government is under increasing pressure to improve consumption as US tariffs threaten the export performance of the world’s second-largest economy. Additionally, it is dealing with deflation and a slowdown in investment, largely due to borrowing restrictions on local governments and the property downturn.

At the same time, the effects of the cash-for-clunkers program are rapidly diminishing, with retail sales growth slowing in July to its lowest point this year. The report recommends that authorities focus on driving demand for unsubsidized goods and services.

“As policymakers are becoming more familiar with a traditional investment-heavy stimulus approach, creating a consumption-centric framework will take time,” the analysts explained.

ADVERTISEMENT:

CONTINUE READING BELOW

Chinese officials are actively seeking services to promote more sustainable consumer spending. Recently, the government rolled out a year-long initiative offering discounted personal consumption loans for a variety of goods and services, including elderly care, education, and tourism.

Similar financial incentives are available for service providers across eight sectors, including catering, accommodation, entertainment, tourism, and sports.

These efforts follow recent government announcements to eliminate tuition fees for children in their final preschool year and to begin nationwide childcare subsidies.

Bloomberg analysts estimate that China’s consumption stimulation measures, along with plans to increase pension payouts, health care spending, and subsidies for disabled elderly individuals, will amount to no more than 600 billion yuan annually. This represents only 0.4% of China’s gross domestic product.

“These small initial actions across various sectors reflect a learning process: experimentation, along with necessary adjustments, will be essential to discover the ideal policy mix for effectively enhancing domestic demand,” the analysts concluded.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.