Recent insights from Santiment reveal that both on-chain indicators and social sentiment are pivotal in pinpointing critical shifts in the cryptocurrency market, highlighting moments from XRP’s peak to Cardano’s low.

Summary

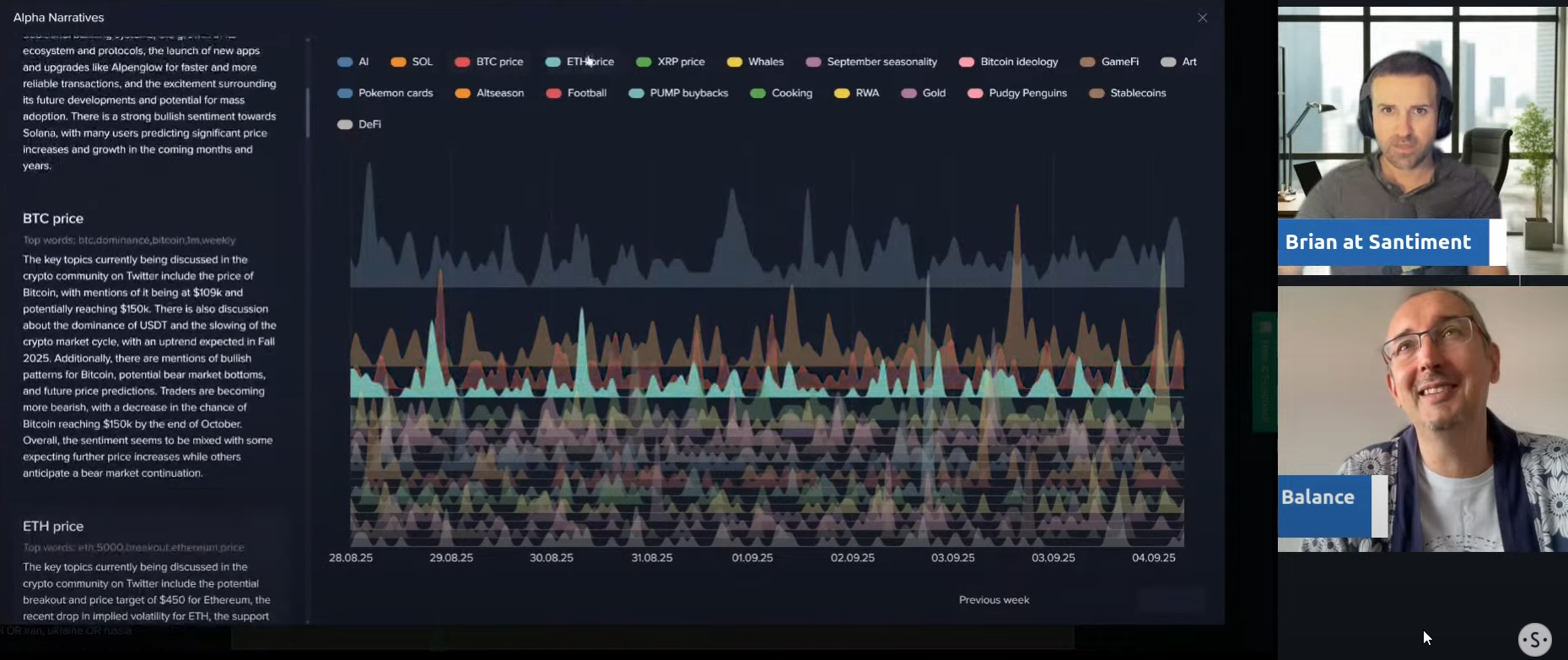

- Santiment indicates that fear has taken hold of the cryptocurrency market sentiment.

- Whale movements signified the peak for XRP, while fear marked the bottom for Cardano.

- Weak economic signals from the U.S. have intensified speculation about potential Fed rate cuts, shaping risk-averse trading patterns.

Bitcoin’s Divergence from Traditional Markets

On-chain data is becoming increasingly crucial for spotting market turning points. Whale interactions successfully pointed out XRP’s recent peak, while extreme fear among investors identified Cardano’s price low.

As discussions about Fed rate cuts steer investor behavior, Bitcoin (BTC) has exhibited an unusual divergence from traditional markets: while stocks have seen slight increases, BTC has been lagging.

This has created a significant gap between assets that usually align closely.

This divergence may offer a buying opportunity if historical patterns hold. Typically, when such divergences occur, Bitcoin realigns with stock market trends, indicating potential for upward movement as the traditional correlation reestablishes.

Bitcoin’s Network Realized Profit/Loss metric has recently spiked during the price pullback, demonstrating healthy capitulation and profit-taking trends.

Conversely, social media sentiment has dipped deeply into negativity just as tokens like DANO started to rise—a classic contrarian signal. As traders pivot from lesser-known altcoins to more established cryptocurrencies, the current climate might be ideal for strategically buying assets that the market currently fears most.

Emerging Contrarian Signals in Altcoin Markets

Cardano exemplifies how contrarian sentiment can signal market opportunities. The token’s price began to recover at the exact moment social media sentiment dipped to extremely negative levels.

Santiment’s exploration of social conversations shows that the crypto community is increasingly fixated on larger cryptocurrencies, with diminished interest in smaller altcoins.

This trend underscores a market scenario where heightened fear can yield buying opportunities for contrarian investors.

The present market conditions indicate that despite the overwhelming fear and struggles of smaller altcoins, such circumstances may lead to new opportunities ahead.

Investors paying close attention to sentiment extremes and on-chain indicators might uncover value in assets experiencing maximum crowd pessimism.

The trend away from smaller altcoins towards established cryptocurrencies illustrates a flight-to-quality mentality that often emerges during turbulent market phases.