Alibaba Group Holding is leading a surge in fundraising among Chinese tech companies, driven by soaring capital requirements amid stiff competition in the artificial intelligence space.

The e-commerce titan is aiming to raise $3.17 billion by issuing zero-coupon convertible notes, which are expected to be the largest of the year. As per details obtained by Bloomberg News, these notes are set to mature in 2032 and will convert into American depositary receipts.

Sources close to the matter indicate that investors have placed enough orders to completely subscribe to the offering, with a request for anonymity due to the confidential nature of the information. Alibaba has yet to provide a response to requests for comment.

The strong demand for financing among Chinese tech firms highlights the intense competition in the industry, where companies are pouring billions into cloud services, AI, and food delivery sectors.

Earlier this week, Baidu, another leading Chinese tech firm, secured 4.4 billion yuan ($618 million) via a dim sum bond offering, following a 10 billion yuan issuance in March. Tencent Holdings is contemplating its first public debt offering in four years, potentially selling offshore yuan bonds as early as this month. Meituan is also assessing a potential dim sum bond issuance.

ADVERTISEMENT

CONTINUE READING BELOW

These funds will allow Alibaba to expand its data centers, advance its technology, and strengthen its international commerce operations, according to the terms outlined. Earlier this year, the Hangzhou-based company revealed plans to invest $53 billion over the next three years in AI infrastructure, including data centers, with the goal of becoming a leader in artificial intelligence.

“Alibaba is adopting a long-term strategy — securing affordable capital, minimizing dilution, and concentrating on growth,” said Ravi Wong, first vice president at Yan Yun Family Office (HK). “It will be intriguing to see how these investments translate into revenue growth.”

In a fiercely competitive environment targeting Chinese consumers, Alibaba faces rivals such as Meituan and JD.com. This week, Alibaba also committed an additional 1 billion yuan to boost traffic to one of its leading online services.

The push for capital across the tech sector further underscores the escalating global competition in AI. Nvidia Corp’s chip supplier, Taiwan Semiconductor Manufacturing Co., reported notable sales growth in August, while Oracle Corp. presented an ambitious forecast for its cloud operations. Last week, Broadcom’s stock rose sharply following a substantial order from OpenAI exceeding $10 billion.

“The belief that rising AI demand will lead to significant earnings growth for China’s cloud computing firms is misguided,” commented Robert Lea, an analyst with Bloomberg Intelligence. “We predict that the ongoing price war and increasing energy costs will keep China’s fragmented cloud sector in the red for the foreseeable future.”

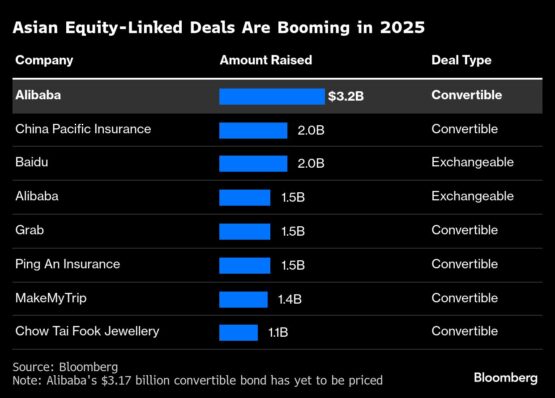

Convertible bond sales in Asia are on the rise in 2025 and are set for multiyear highs. This financial instrument provides a more cost-effective approach to raising funds compared to traditional debt, especially given the high-interest rates and increasing stock prices creating a favorable environment for this sector.

China Pacific Insurance (Group) Co. is also leveraging the convertible bond market, raising HK$15.6 billion ($2 billion) through this financial instrument.

ADVERTISEMENT:

CONTINUE READING BELOW

In 2024, Alibaba issued $5 billion in convertible bonds, the largest dollar-denominated offering by an Asian company at the time. In July, the company garnered HK$12 billion from bonds exchangeable into shares of its subsidiary, Alibaba Health Information Technology.

The latest notes from Alibaba come with a conversion premium ranging from 27.5% to 32.5% above the reference price, as indicated by the reviewed terms. A 90-day lock-up period applies to the issuer following the pricing date.

On Thursday, Alibaba’s shares fell as much as 2.6% to HK$139.10 in Hong Kong, following a decline in its ADRs in the US. Nevertheless, the stock has surged nearly 70% this year.

This fundraising frenzy is also generating considerable opportunities for investment bankers.

Barclays Plc, Citigroup, HSBC Holdings Plc, JPMorgan Chase & Co., Morgan Stanley, and UBS Group AG are participating in Alibaba’s latest offering. Additionally, BNP Paribas SA, Deutsche Bank AG, and Mizuho Securities Co. are also providing assistance, according to the deal terms seen by Bloomberg.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.