Since early August, Ethereum has consistently outperformed Bitcoin in spot trading volume, and this trend continues unabated.

Summary

- Ethereum’s spot trading volume has regularly surpassed that of BTC

- This trend suggests a migration of traders towards altcoins

- Expected rate cuts by the Fed enhance a positive outlook for altcoins

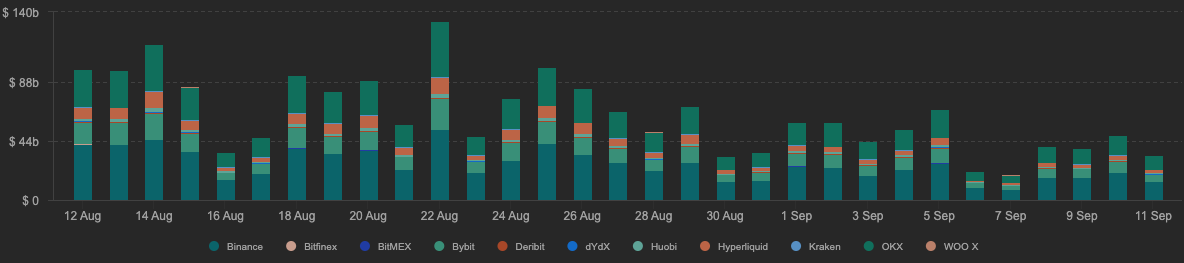

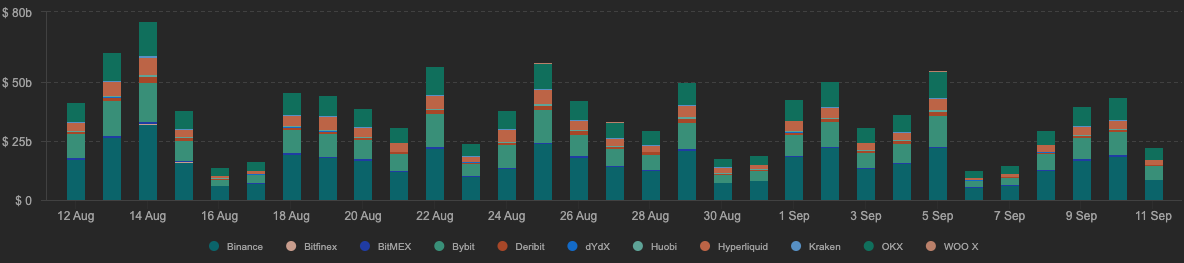

For many years, Bitcoin was regarded as the top asset in market liquidity. However, as BTC stabilizes near its historical highs, investors are slowly turning their attention to altcoins, with Ethereum being the principal beneficiary. As of September 11, Ethereum remains the leader in spot trading volume, continuing a trend that initiated in early August. Notably, this marks the first time in seven years that Ethereum has exceeded BTC in this metric.

From early August to September 9, Ethereum’s (ETH) trading volume accounted for 32.9%, according to CryptoRank, while Bitcoin’s (BTC) volume was slightly lower at 32.6%. This trend persisted, with Ethereum’s spot trading volume hitting $48 billion on September 10, in contrast to Bitcoin’s $43 billion.

ETFs reveal diverging paths for Ethereum and Bitcoin

The increase in Ethereum’s spot volume corresponds with a divergence in ETF flows between Ethereum and Bitcoin. Notably, as reported by VanEck, Ethereum ETFs registered $4 billion in inflows during August, while Bitcoin ETFs experienced outflows.

This divergence likely reflects a growing risk appetite among investors. With Bitcoin nearing its all-time high and expectations of rate cuts from the Federal Reserve, investors are more willing to consider riskier assets that could offer greater returns.

As a result, Ethereum traders are testing the resistance levels of $4,400 to $4,500 while trading above $4,200. These levels are currently critical for the asset. A breakout above this zone could push the coin to $5,000, while a fall below support may drive it down under $4,000.